World Liberty Financial price

in USD$0.2185

+$0.0005 (+0.22%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

$5.96B

Circulating supply

27.26B / 100B

All-time high

$0.35

24h volume

$478.36M

About World Liberty Financial

World Liberty Financial’s price performance

Past year

--

--

3 months

--

--

30 days

--

--

7 days

+4.79%

$0.21

World Liberty Financial in the news

WLFI edges higher on the week as holders rally behind a deflationary strategy to counter post-launch weakness.

Justin Sun has called on World Liberty Financial (WLFI) to reverse the blacklisting of his...

Sun is a key investor in the project and holds around $700 million worth of WLFI tokens, mostly vested.

World Liberty Financial (WLFI) has blacklisted an address linked to Justin Sun, freezing about 540...

WLFI, issued by Trump-backed DeFi firm World Liberty Financial, went live on leading exchanges today...

Coinbase has placed World Liberty Financial USD (USD1) on its listing roadmap, indicating that the...

World Liberty Financial on socials

It's been exactly 2 weeks since the last pump, and I see everyone is talking about pumping again 😅

On the 16th - 17th, there's the FOMC meeting and interest rate decision, I don't want to take risks during this period, so I've decided to stay out.

It's not too late to enter once everything is clearer ✨

I've been observing that $SOL and $HYPE are still quite strong, keeping these two on my watchlist and waiting for the m5 uptrend to complete before going Long, then it should be fine.

Vinh Nguyen 🦅🟠 $FF

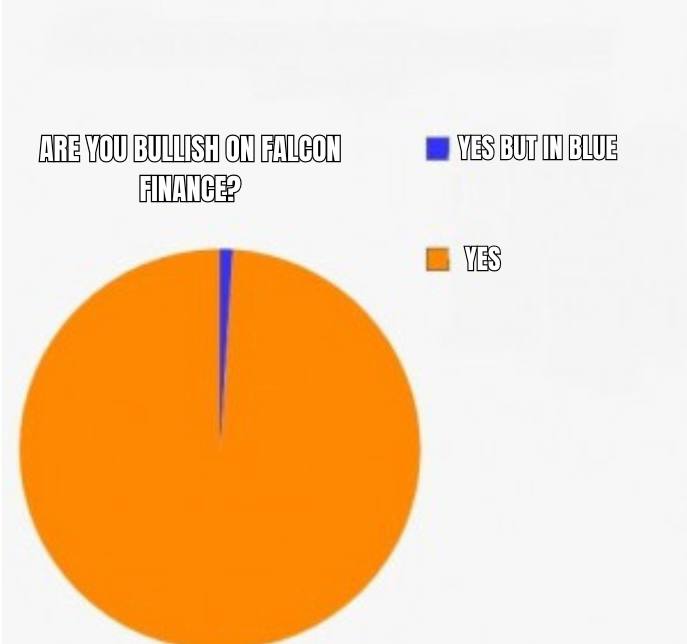

Falcon Finance: The on-chain liquidity revolution with $FF 🦅🟠

In the ever-evolving DeFi landscape, one project is emerging as the new standard for on-chain liquidity – Falcon Finance.

With the upcoming launch of the $FF Community Sale on Buidlpad, the community will have the opportunity to participate in the next growth phase of an infrastructure aiming for a trillion-dollar scale.

Falcon Finance – Universal Collateralization

What sets Falcon apart is its universal collateralization infrastructure – allowing any asset that can be collateralized, from BTC, ETH, SOL, stablecoins to tokenized RWAs like treasury bonds, to be converted into USDf, an over-collateralized synthetic dollar.

USDf is the core of Falcon:

- Users can mint USDf by collateralizing assets.

- Or stake USDf to receive sUSDf, a yield-bearing token compliant with ERC-4626.

- sUSDf generates yield through arbitrage funding rate strategies, cross-exchange, altcoin staking, and allocation to DEXs. The result is a sustainable and transparent yield stream for both organizations and individuals.

Scale & Appeal of the Ecosystem

In just 8 months, Falcon has achieved impressive numbers:

1⃣ Over $1.5B USDf in circulation

2⃣ Over $1.6B in reserves

3⃣ 58,000+ active users each month

4⃣ sUSDf 30-day APY: 10%, far exceeding the average 6.29% of the top 5 stablecoin yield protocols

Falcon has also deeply integrated into the ecosystem:

1⃣ $273M TVL on Pendle, enabling the tokenization of USDf/sUSDf yield

2⃣ Morpho supports borrowing with sUSDf

3⃣ Liquidity pools on Curve, Uniswap, PancakeSwap, Bitfinex, MEXC

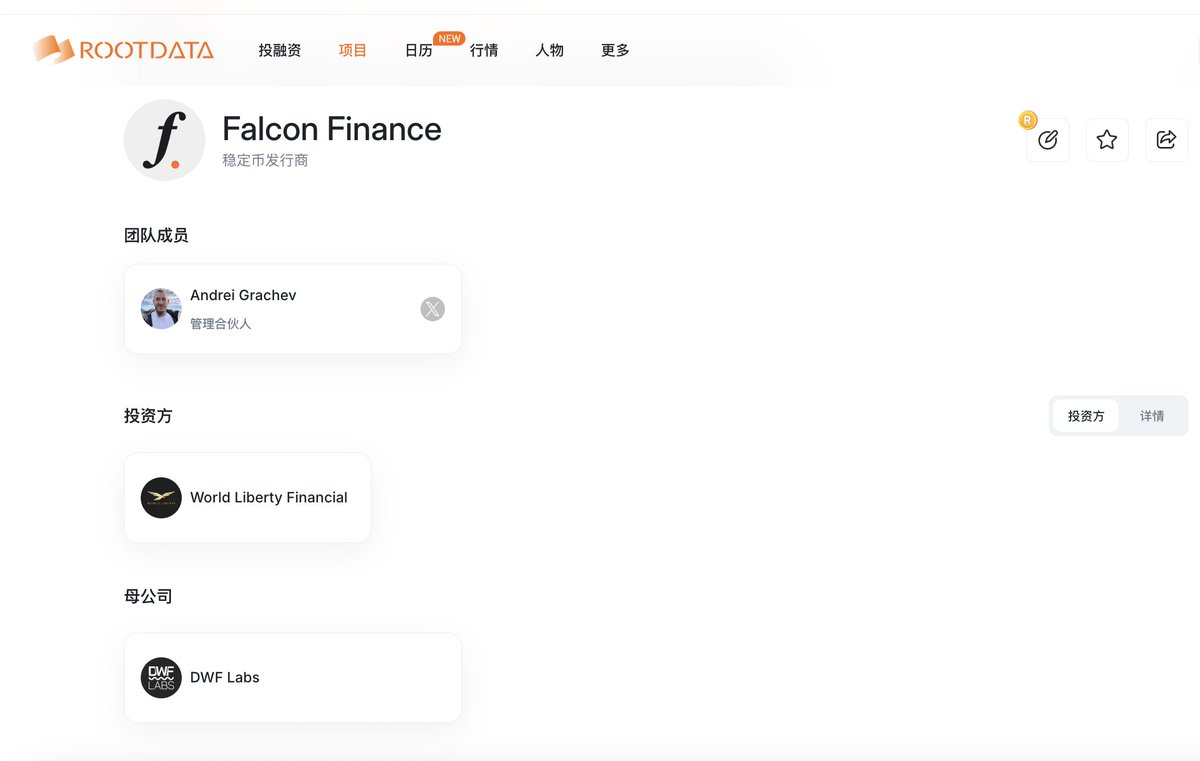

4⃣ Chainlink as the pricing oracle, with a $10M strategic investment from WLFI

All of this demonstrates the real demand for USDf and sUSDf in DeFi.

$FF is the native token of Falcon, directly tied to the expansion of the ecosystem. As USDf adoption increases, the value of $FF is further solidified. Holding $FF not only provides usage benefits but also represents a long-term growth approach for Falcon – an infrastructure designed for trillions in assets.

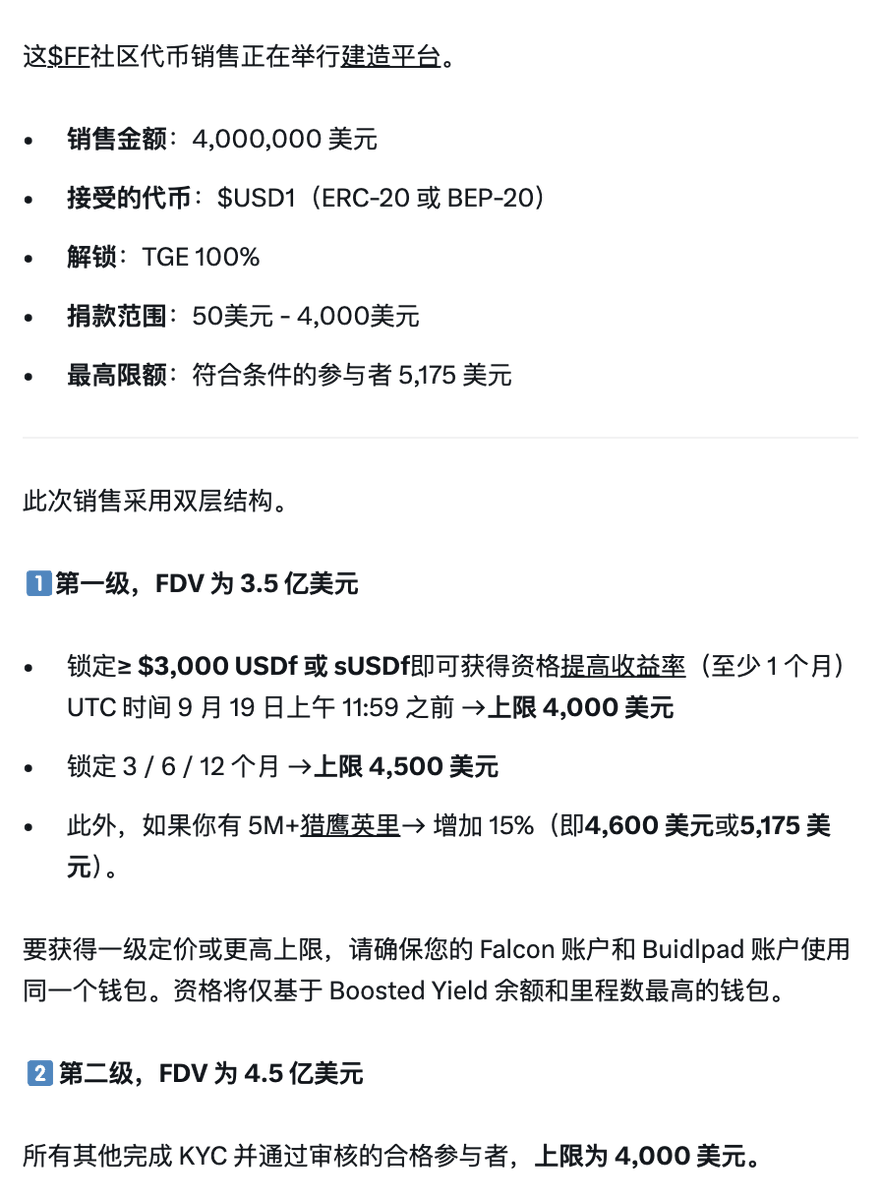

$FF Community Sale Information

Sale size: $4,000,000

Unlock: 100% at TGE

Accepted tokens: USD1 (ERC-20/BEP-20)

Contribution range: $50 – $4,000 (up to $5,175 for stakers/Miles holders)

The 2 Tier pricing model is quite interesting:

Tier 1 ($350M FDV): For those who stake ≥$3,000 USDf/sUSDf in Boosted Yield.

Tier 2 ($450M FDV): For all other users who have completed KYC.

Timeline for you to follow:

Phase 1 (16–19/9): KYC + Registration

Phase 2 (22/9): Review of registrations

Phase 3 (22–23/9): Contribution

Phase 4 (26/9): Settlement & Refund

Offers & Rewards

Falcon and Buidlpad encourage loyal users:

Long-term stakers in Boosted Yield have a contribution cap of up to $4,500.

Holders of >5M Falcon Miles: an additional 15%, capped at $5,175.

HODL staking on Buidlpad: 50% Miles bonus multiplier.

Notably, 20% of the allocation is reserved for community supporters & content creators – those who help spread Falcon's vision.

Additionally,

@buidlpad is known for its fair and transparent criteria, reducing the dominance of VCs and airdrop farmers. With over $220M committed through 3 previous campaigns (Solayer, Sahara AI, Lombard), Buidlpad is returning token access to the community.

Falcon Finance is not just a stablecoin protocol – it is an infrastructure layer for the next generation of on-chain liquidity. With USDf and sUSDf reaching billion-dollar scales in just a few months, $FF is becoming the gateway for the community to participate in this expansion.

Last ten minutes of life and death speed, tweeting! @buidlpad's new project, the Trump family's @FalconStable USDf, and automatically earn income by holding sUSDf.

It can be understood as a more powerful "yield wallet." Some mainstream coins, and even some bond tokens in the future, can be stored as "collateral." The issued $USDf is also pegged to the US dollar at a 1:1 ratio.

Behind Falcon is Andrei Grachev, a partner at DWF Labs. Moreover, Falcon received a $10 million strategic investment from @worldlibertyfi Liberty Financial $WLFI at the end of July, and the stablecoin USD1 under WLFI is naturally included in the Falcon collateral system. This deep binding also helps Falcon gain resources from the traditional political field.

According to data, the Falcon ecosystem has already reached a supply of $1.5 billion USDF and a total reserve of $1.6 billion, with over 58,000 active users each month, and the annualized yield of sUSDf is as high as 10%.

💰 Where does such high yield come from?

It claims that its income mainly comes from "professional on-chain strategies," the most important of which is to exploit small price differences between different exchanges for "arbitrage," especially when the cryptocurrency market is highly volatile, such opportunities are more frequent. In addition, it will also participate in the lending market, lending out collateral to earn interest. The team will manage these funds through a set of automated strategies and manual supervision, striving to obtain returns while controlling risks.

✨ The innovation of Falcon Finance lies in

- Generating the stablecoin USDf through multi-asset over-collateralization, increasing flexibility.

- Automatically accumulating income for users in the form of yield-bearing token sUSDf, making the user experience simpler.

- Attempting to provide sustainable high returns under controllable risks through professional arbitrage and lending strategies.

"Public sale of the native token $FF"

Total fundraising amount: $4 million

Token unlock: 100% unlock at TGE

Accepted tokens: USD1 (ERC-20 / BEP-20)

Participation range: $50 - $4000

Maximum limit for special condition users: $5175

How can we participate:

🎯 Participate in ecological interactions to earn points - Miles

The core of this method is to accumulate Miles points by using Falcon's products, hoping to receive airdrop rewards in proportion to points when the protocol issues governance tokens in the future.

⏭ Directly mint USDf (recommended, high points multiplier): On the Falcon official app, use the "Mint" function to deposit collateral assets to generate USDf. This can earn a higher points multiplier than directly exchanging on decentralized exchanges (DEX).

Classic model: Deposit stablecoins (like USDT, USDC) to mint USDf at a 1:1 ratio, earning 2x points.

Innovative model: Deposit non-stablecoin assets like BTC, ETH for over-collateralized minting of USDf, earning up to 18x points.

It should be noted that completing these official app mint functions requires KYC. This area needs to be looked at.

⏭ Buy and hold USDf on DEX: Directly purchase USDf on decentralized exchanges like @Uniswap, @PancakeSwap. This method does not require KYC, which is convenient, but usually has a lower points multiplier (for example, simply holding USDf can earn 6x daily points, while trading on DEX only earns 2x points).

⏭ Stake USDf to obtain sUSDf, stake USDf on Falcon's Earn page to exchange for sUSDf, which can earn income (current APY is about 8.71%-13.07%):

Option 1️⃣: Choose flexible staking, points multiplier is 1x.

Option 2️⃣: Choose Boost lock-up staking (3, 6, or 12 months), which can earn a one-time high points multiplier of 15x to 40x, and the APY will also be higher.

⏭ Provide liquidity (LP):

Pair USDf with other assets (like USDC, USD1) and provide liquidity on DEX (like Uniswap, PancakeSwap), earning up to 40-60x points. This is suitable for users familiar with DeFi operations.

⏭ "One fish, multiple eats" through other DeFi protocols

You can deposit USDf or sUSDf into other DeFi protocols that support Falcon points, while earning Miles points and the native yield of that protocol.

For example, providing USDf in the lending pool of Silo Finance may yield about 13% APY and 30x Miles points.

Or use yield tokenization protocols like Pendle to buy YT (yield tokens) to aim for higher points multipliers (the YT points multiplier for sUSDf once reached 118x). Such operations are more complex and carry relatively higher risks.

The timeline for this is on the 22nd, starting to deposit money at 18:00, for one day.

💰 Directly use products to obtain stable income

- If you are not so concerned about airdrops and mainly want to find a relatively stable source of income, you can:

- Mint USDf on the official app: Deposit your stablecoins or mainstream cryptocurrencies (like BTC, ETH) to generate USDf.

- Buy USDf on DEX: Directly buy USDf on exchanges like Uniswap as you would with any other token.

- Stake for yield: Stake your USDf on the Falcon official website to exchange for sUSDf, thereby automatically earning the income generated by the protocol (currently the APY for sUSDf is around 8.71% - 13.07%, depending on whether it is locked).

Combined yield: You can also invest USDf or sUSDf into other DeFi protocols you trust (like Morpho, Euler, etc.) for lending or providing liquidity to try to obtain combined yields.

For most of us users, the most direct way to participate might be to go to Uniswap to buy some USDf, and then exchange it for sUSDf on the official platform to earn income. If you are optimistic about its long-term development and willing to take on more risks, then consider deep interactions through official minting, locking, LP, etc., to seek greater potential returns.

Looking forward to Buidlpad X Trump family X stablecoin DeFi three-way collaboration, expected multiplier is over 2X. Waiting for the recent two Buildpad projects 🙏 $BARD $FF

Orange Evening Interpretation 9.16

The whole world is at a new high, and there is almost a pie! Last night, the S&P and Nasdaq both reached new highs, Lao Ma bought his own stocks for a billion, and it seemed that he was going to use his banknote ability to unlock a 1 trillion salary package, Tesla's three consecutive rises have stabilized at 410, and Google has also reached a new high and rushed into the 3 trillion market value club; Gold also hit a new high last night, breaking through 3680.

In short, on the eve of the opening of the interest rate cut channel, all assets are ready to meet the new liquidity of the market, so that although the BTC also climbed up last night, but there is no ATH is also a weak chicken, but as I said earlier, it is a good thing to fall before the interest rate cut, which is equivalent to releasing the bearish selling pressure of the good landing in advance, because crypto does not have much fundamentals to talk about compared to the stock market, so US stock investors do not pay as much attention to the FOMC interest rate meeting as those who speculate in currency, so the currency market actually reacted in advance. The most taboo thing about currency speculation is to pay too much attention to what is happening at the moment, the certainty opportunity is always in the long run, in the long run, this year's interest rate cut 75 basically opened the interest rate cut bull, next year Trump fully controls the Fed, the rate of interest rate cuts is likely to double super, as for last night's news, Trump's dismissal of Cook was rejected by the court, Cook continued to participate in the FOMC vote in September, this kind of news can be ignored, because they are all processes, the result of certainty is that crazy interest rate cuts will definitely come, imagine that in the future, the interest rates on deposits and U.S. bonds in the old US bank will drop to 1% , the APY on the currency circle chain has risen to 10%, how many funds will pour in.

Then let's talk about the SOL strategy, although SOL began to stabilize yesterday and is no longer crazy upward, that is the SOL strategy is indeed following the old path of the ETH strategy, and the bmnr on SOL has basically come out, that is, ford, this is the SOL micro strategy of Galaxy Digital, Jump and Multicoin, and within a few days, it threw $1.6 billion into the market, and directly copied 6.82 million SOL at the secondary level. It has become the treasury company with the most sol reserves, the 2-5 treasury is STSS, DFDV, UPXI, GLXY, and the coins are basically about 200w coins, the SOL treasury has not had much voice before because these coins are too few and too average, there is no obvious leader such as BMNR, and TOM lee is a Wall Street leader, and now FORD has basically completed the first step, throwing off the competitors behind it, but the volume is a little smaller, But as long as SOL continues to take off, a new god will naturally be born; Then there is another invisible opponent, Xia Yan Capital and Pantera's new SOL micro-strategy HSDT, which has officially announced yesterday that it has raised 500 million dollars, it seems that the goal is to compete with Ford, these two institutions are also very awesome, Pantera now holds SOL worth 1.1 billion, and this 1.1 billion is already on par with Ford, so the next SOL will stage a wave of leading battles, no matter who has the last laugh, anyway, coin holders can eat meat.

Then say ETF, this week Doge and XRP's spot ETFs should be listed, this issuer REX has been officially announced, and then Trump and BONK are on standby, but the date has not been announced, but it should not be too useful, REX applied for this ETF is not so difficult; Last night, BTC, ETH and SOL ETFs all saw net inflows of funds, BTC inflows of 260 million, Ethereum inflows of 360 million, and SOL inflows of 900W, although okay but still too little compared with the purchase of the SOL strategy, which also raises a problem, that is, for copycats, the attractiveness of ETFs to over-the-counter funds is not as good as that of treasuries, because the hidden leverage of treasury funds makes funds more efficient, especially the risk-return ratio of buying leading treasury stocks is relatively low. It is more acceptable to over-the-counter retail investors, which leads to the fact that even if spot ETFs such as XRP and DOGE are listed, the capital flow that may be brought is not too large, and only after the treasury effect is up, there will be a sharp rise in the market.

Finally, the market, ETH/BTC is still falling, probably because the recent increase in ETH treasury has entered a bottleneck, last night bmnr bought 8w ETH, other institutions did not buy, the micro strategy on the BTC side is also buying, in contrast, the popularity of the SOL strategy will suck away part of the ETH funds, which has little impact on the BTC, and ETH is experiencing the peak period of un-staking, once the contact and addition reach the dynamic balance, ETH will return, Moreover, ETH still has the potential to pledge ETFs. The copycat side is basically following the market to do shocks, now the BTC has no ATH, the copycat does not dare to rashly pull the market, some have obvious benefits first, such as $pump The live broadcast has been particularly popular in the past few days, and there has also been a $kind $streamer $ftp kind of golden dog, the platform's revenue has exceeded hype for two consecutive days, and this has not been fully rolled out, and even the platform collapsed last night, and I can't imagine how strong the complete pump will be; Then the base wants to issue coins to bring up the base ecological project, polymarket is said to also issue coins, the released documents write that financing uses other warrants, which generally refers to cryptocurrency, PM's trading bot $pcule directly rushed to a new high of 24m; Then $wlfi is a little uncontrollable, there is a small wave of headwinds, I have always been optimistic about this project, don't look at the FDV big, the rise will not be weak, other copycats will not say much, this round is to sell leftover coins to buy the leading coin, and the deposit can be rushed $xpl in the evening.

Guides

Find out how to buy World Liberty Financial

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict World Liberty Financial’s prices

How much will World Liberty Financial be worth over the next few years? Check out the community's thoughts and make your predictions.

View World Liberty Financial’s price history

Track your World Liberty Financial’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Own World Liberty Financial in 3 steps

Create a free OKX account

Fund your account

Choose your crypto

World Liberty Financial on OKX Learn

World Liberty Financial WLFI Price: Key Insights, Governance, and Market Dynamics

Introduction to World Liberty Financial (WLFI) Price and Project Overview World Liberty Financial (WLFI) has emerged as a prominent cryptocurrency project, gaining widespread attention due to its asso

WLFI Price Prediction: Can World Liberty Financial Token Reach $1?

WLFI Price Prediction: A Comprehensive Analysis for 2025 World Liberty Financial (WLFI) has quickly become a prominent name in the decentralized finance (DeFi) space. Its association with Donald Trump

Token, Financial, Billion: Inside World Liberty Financial’s $1.5 Billion Crypto Strategy

Introduction to World Liberty Financial’s $1.5 Billion Fundraising Plan World Liberty Financial (WLFI), a cryptocurrency-focused company with backing from the Trump family, has announced an ambitious

World Liberty Financial (WLFI) Sets New Standards in Transparency with Token Lock Strategy and Decentralized Governance

Introduction to World Liberty Financial (WLFI) World Liberty Financial (WLFI) is revolutionizing the decentralized finance (DeFi) space with its innovative strategies that prioritize transparency, fai

World Liberty Financial FAQ

Currently, one World Liberty Financial is worth $0.2185. For answers and insight into World Liberty Financial's price action, you're in the right place. Explore the latest World Liberty Financial charts and trade responsibly with OKX.

Cryptocurrencies, such as World Liberty Financial, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as World Liberty Financial have been created as well.

Check out our World Liberty Financial price prediction page to forecast future prices and determine your price targets.

Dive deeper into World Liberty Financial

World Liberty Financial (WLFI) has taken a major step forward, evolving from a governance-only asset into a publicly tradable cryptocurrency. This transformation, backed by an overwhelming 99.94% approval from token holders, marks a defining moment in WLFI’s trajectory. As it enters open markets, the token has drawn both interest for its financial potential and scrutiny over its origins and governance.

WLFI’s Role in the USD1 Stablecoin and DeFi Ecosystem

WLFI is not simply a stand-alone cryptocurrency. It is a central component of a wider decentralized finance (DeFi) ecosystem, built around USD1, a dollar-pegged stablecoin used for lending and borrowing. Through this integration, WLFI gains functional utility: users can stake, lend, borrow, and participate in on-chain governance. This dual role — governance plus DeFi — strengthens WLFI’s positioning as more than just a speculative asset, but as part of a larger financial infrastructure.

ALT5 Sigma’s Contribution to Market Entry

A key enabler of WLFI’s move into public trading has been its partnership with fintech company ALT5 Sigma. Acting as a “Nasdaq vault” for the token, ALT5 Sigma leverages its fintech licenses to navigate regulatory frameworks while supporting WLFI’s listing. While this partnership has given WLFI a compliant appearance, some critics argue it represents a “backdoor” approach to avoid stricter oversight. This tension highlights the fine line WLFI must walk between innovation and regulatory acceptance.

International Investment and Partnerships

WLFI has secured interest from investors in the UAE, Hong Kong, and Singapore, signaling its ambition to expand globally. While these partnerships strengthen its international presence, they also add layers of regulatory complexity. In some cases, investor backgrounds have raised questions about compliance and governance standards. How WLFI manages these international collaborations will play a central role in its long-term market positioning.

Tokenomics: Phased Release Strategy

To stabilize the market and prevent supply shocks, WLFI has introduced a phased token release system. Allocations for founders and team members are subject to extended vesting periods, limiting immediate supply and reducing the risk of oversaturation. This measured approach aims to support price stability, bolster investor confidence, and create a more sustainable market environment as WLFI scales into public trading.

Branding, Politics, and Expansion

WLFI has been deliberately positioned as a “political mint,” using the Trump family’s brand recognition to attract attention and investment. This unique positioning has helped the token stand out in a crowded cryptocurrency market. However, its heavy reliance on political branding raises questions about resilience. As WLFI pushes into new international markets, it must prove that operational credibility, not political association, is the foundation of its growth.

Retail Investor Risks

For retail investors, WLFI presents both opportunities and risks. The project’s political ties, offshore structures, and regulatory gray areas could complicate transparency and compliance. While the phased release strategy is designed to stabilize markets, it may also constrain liquidity. Investors are strongly advised to evaluate fundamentals carefully, conduct independent due diligence, and weigh these factors before engaging.

Conclusion: Navigating an Uncertain Future

WLFI sits at the intersection of cryptocurrency, politics, and finance — a position that creates both unique opportunities and significant challenges. Its move into public trading expands its utility and reach, particularly through integration with the USD1 stablecoin and the broader DeFi ecosystem. Yet, unresolved questions around ethics, regulation, and concentrated ownership remain pressing.

WLFI’s journey is still unfolding. Whether it becomes a lasting player in the crypto economy or a cautionary tale will hinge on how effectively it balances ambition with accountability.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$5.96B

Circulating supply

27.26B / 100B

All-time high

$0.35

24h volume

$478.36M