$SOL: Agents, Alpenglow, and ETF Flows Drive Catch Up Trade (TP: $300 YE, $400 ’26) - Trades ~$207 after a clean $180→$203 breakout; SOL/BTC and SOL/ETH pairs firming W/W as SOL outperforms large cap. - Ecosystem TVL + stablecoins issued ~$34B (+200% YoY); liquid staked SOL mcap $11.7B (13.6% of staked SOL), with CEX issued LST TVL >$2.8B. - Inflows: $177M weekly into SOL funds ($1.3B YTD); >$1B bridged in August (incl. $661M from Ethereum); Jupiter Lend $800M TMV ($344M+ stables), hylo deposits 10× to $22.7M; RWAs >$500M. - Infra drivers: Coinbase x402 adds Solana; Alpenglow passes governance; perps volume hits $43.9B record; August DEX volume $144B; Pyth feeds power U.S. Commerce GDP data; LBTC arrives via Lombard; Maple loops earn up to 58% on syrupUSDC; first U.S. SOL staking ETF (SSK) AUM $219M; Metalpha deploys BTC liquidity. - Forward look: Multiple spot SOL ETFs signal constructive SEC engagement; stablecoin stack expands; LST share shifts (bnSOL vs JitoSOL/dzSOL)...

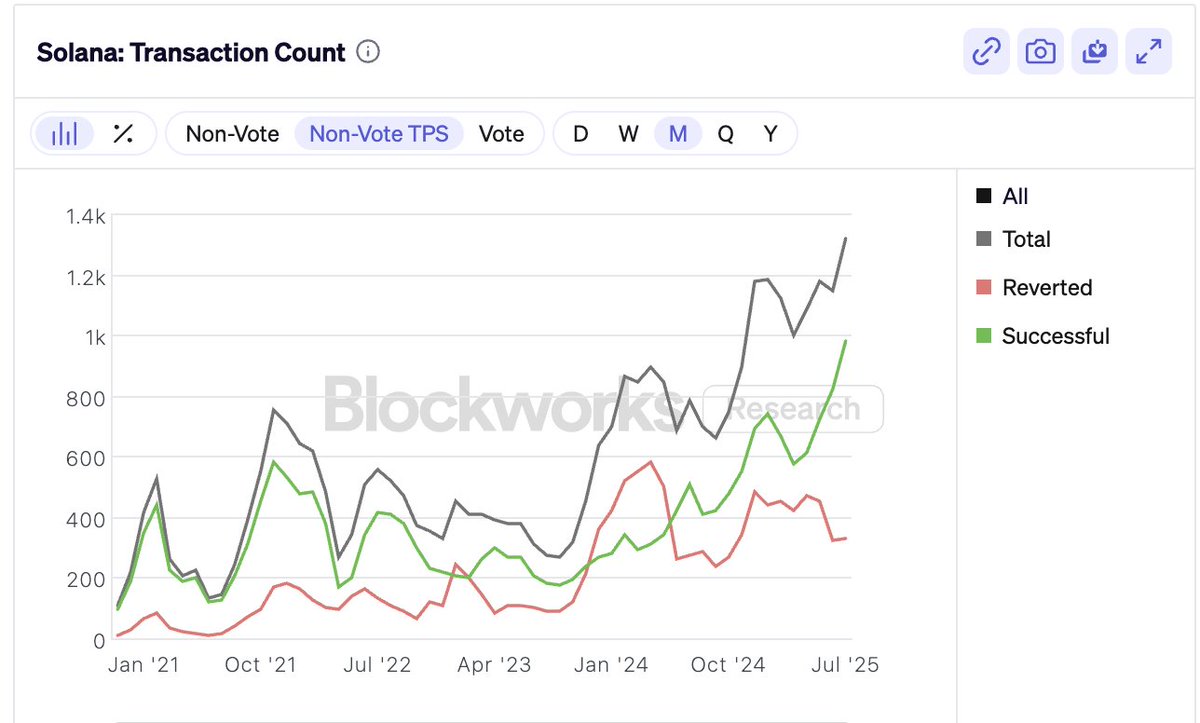

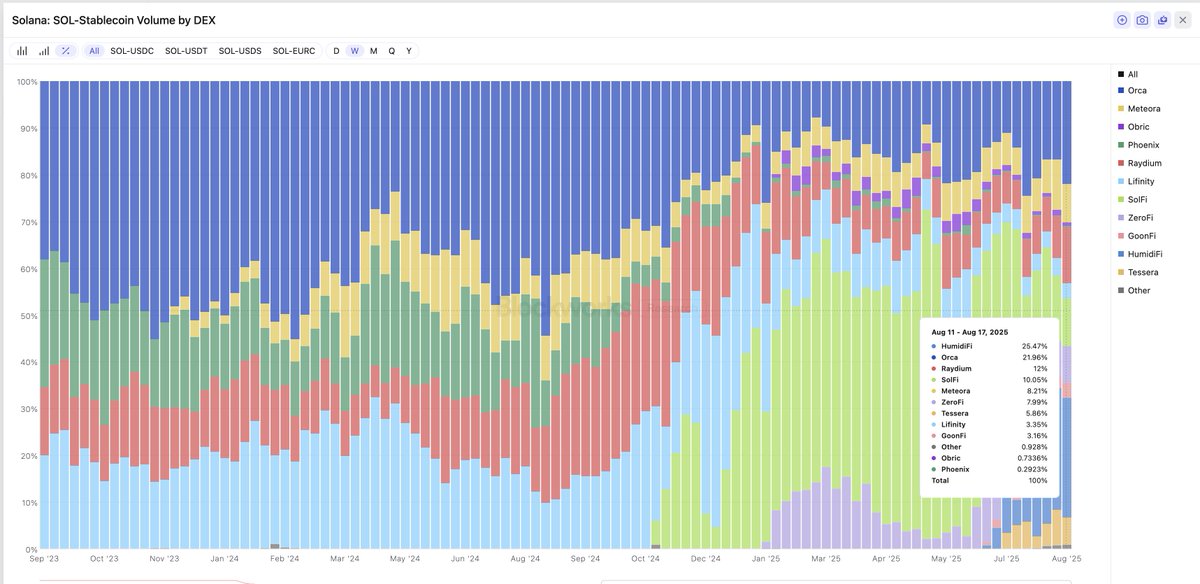

Remain Very Bullish on $SOL, TP $300 EoY -Mcap $101.5B (vs $83B in Q2, +22% since); TVL $10.6B (vs $8.6B in Q2, +23% since).; ~$2.5B avg daily DEX volume. -Stablecoin supply $11.4B (3x since Jul ’24); $215B transferred in Jul; 50% of USDC transfers now on Solana. -Bullish IPO settled $1.15B in stablecoins, majority minted on Solana, first use at scale in a U.S. public listing. -Performance: blockspace +20% (plans to double); throughput hit 107,664 TPS burst; reverted txns down, success rates up; fees stable. -Infra: Frankendancer + DoubleZero adoption; finality upgrade to 100-150ms; Jito BAM (private pre-execution), Helius Shreds + archival; pToken upcoming. -DeFi: Raydium >$1T volume; SOL-stable pairs now split across 9 DEXes with <0.5bp spreads; rising competition from AMMs, tg bots, routers, launchpads. -RWAs: $488M live (+140% YTD); xStocks 60+ U.S. equities with $2B volume in 6 weeks; r3 bringing $10B pipeline; tokenized gold, spirits, collectibles emerging. -BTCFi: Bitlayer +...

8.68K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.