Okay so this had me look into the numbers ngl

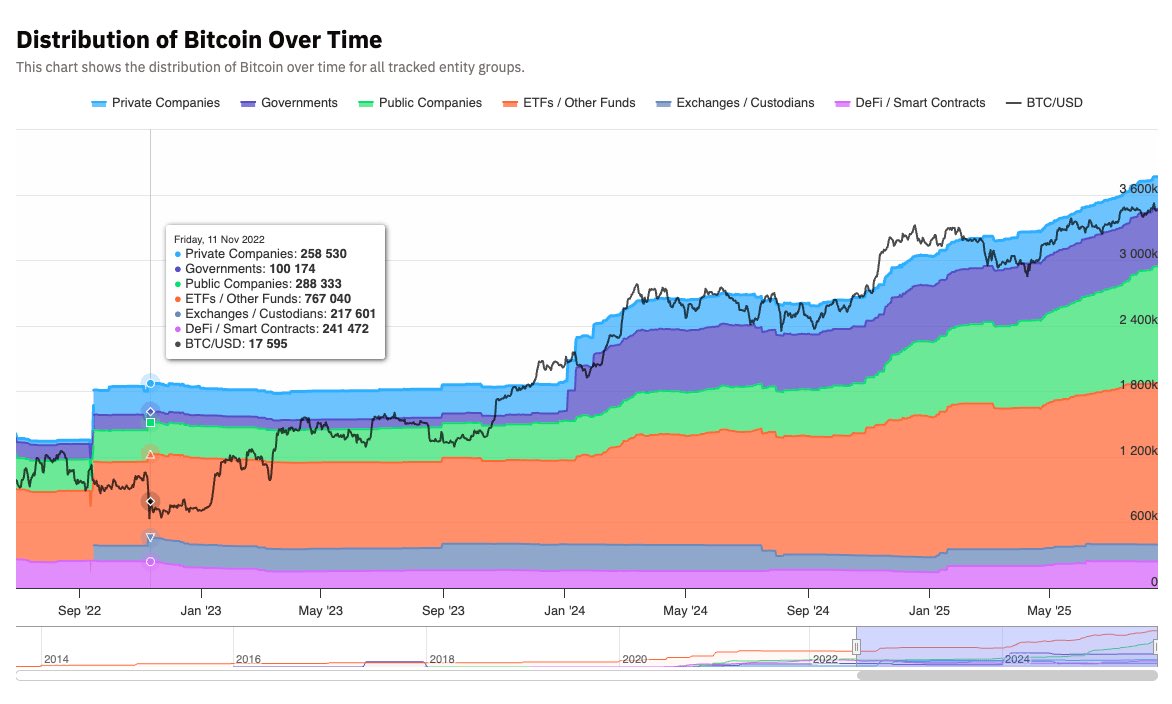

$BTC distribution since late 2022:

▸ Private Cos: 258k → 292k (+13%)

▸ Governments: 143k → 526k (+267%)

▸ Public Cos: 288k → 1.04m (+261%)

▸ ETFs / Funds: 767k → 1.47m (+92%)

▸ DeFi: 245k → 242k (−1%)

DeFi basically flatlined while every other bucket stacked heavy.

While most of the BTC in ETFs and treasuries is inert, just sitting for exposure with zero yield.

As treasury competition heats up, some of that flow will inevitably look at DeFi for yield.

Take $CORE for example, their dual-staking sits at ~5.5% APY.

If just 2% of private company holdings (~5.8k BTC) rotated in, that’s ~$35M yearly yield unlocked.

There’s already 5K+ BTC staked at @Coredao_Org btw

And this is only private cos, who are more flexible with allocation. Imagine when public cos or funds get regulatory clarity to chase yield.

That not only puts idle BTC to work, it also sparks a structural supply crunch flywheel for $CORE

So yeah BTC DeFi infra like Core feels like an asymmetric bet if treasuries start chasing yield

8.92K

52

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.