Ben Thompson’s aggregation framework explains why apps like Jupiter become default gateways, they answer all 3 questions:

1. What’s the incumbent differentiator, and can it be digitized?

In DeFi, the differentiator is liquidity. Whoever has the deepest pools wins. This liquidity is already digital -> easy to scan, compare, and route between.

2. Once it’s digitized, does competition shift to UX?

Yes. If anyone can plug into liquidity, the real battle is about execution: faster settlement, fewer failed transactions, smoother design.

3. If you win UX, can you trigger a flywheel?

Great UX pulls in more users -> which pulls in more liquidity -> which makes the UX even better. That cycle is how winners entrench.

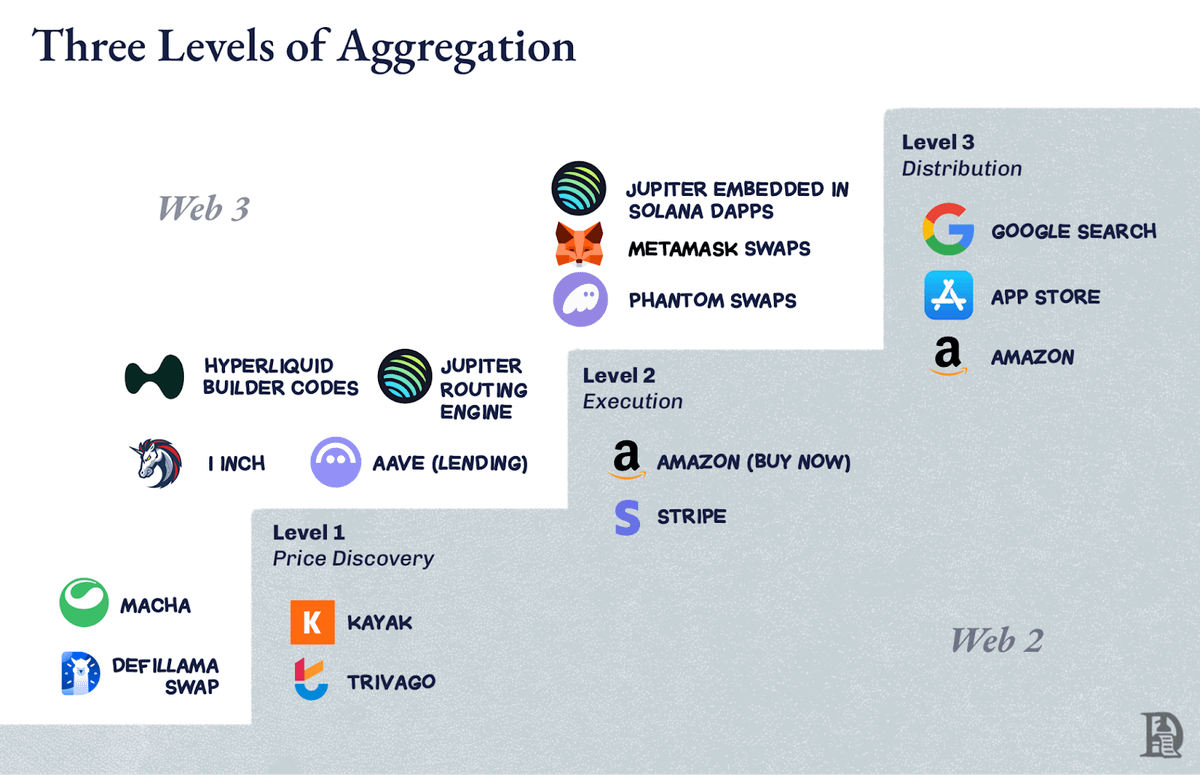

This leads to the 3 levels of aggregation:

- Level 1: Price Discovery

Just show users the best deal. Kayak for flights, 1inch/Matcha for DEXs. Useful, but fragile if the market is already concentrated (e.g., ETH spot on Uniswap), routing adds little value.

- Level 2: Execution

Don’t just point to the deal - do it. Amazon’s “Buy Now” button is the template. In DeFi, Aave sits here: liquidity is already in the contracts, and the execution experience (fast settlement, no failures) is tied to the protocol.

- Level 3: Distribution Control

This is the holy grail - be the starting point. Google Search for the web. The App Store for mobile. And on Solana, Jupiter.

Jupiter’s success on Solana:

Started as price-finder -> added smart routing (execution) -> embedded across wallets like Phantom (distribution).

Now, most Solana trades are Jupiter trades even if users never open Jupiter’s website. Jupiter didn’t just help users find liquidity it became the gateway through which liquidity flows. That’s how you go from “helpful tool” to the market itself.

Read our full article to learn more (link below)

Show original

8.2K

41

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.