$LINK just hit $24 but there's more happening behind the scenes than most people realize.

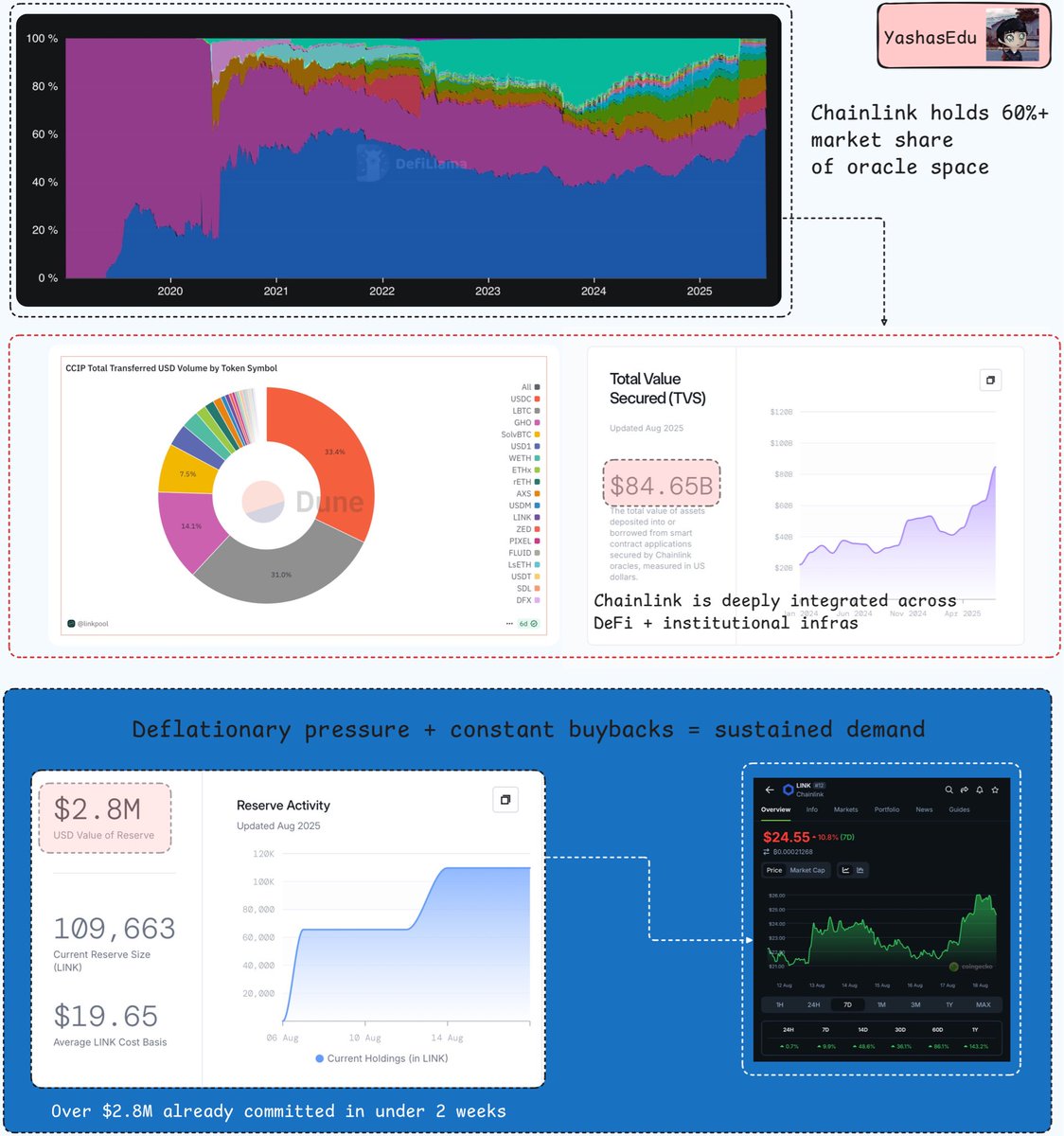

@chainlink started as an oracle (basically a data feed that tells smart contracts what's happening in the real world). They still dominate that space with 61.69% market share & $84.6B in total value secured.

> TVS is $84.6B (7x larger than @PythNetwork)

> 21 chains supported

> 18B+ messages sent to smart contracts

But calling Chainlink just an oracle today is not right. It has expanded into…

➠ CCIP: Crosschain protocol moving $1.3B+ in transactions across 60+ chains

➠ ACE: Compliance engine for traditional finance integration

➠ Data streams: Real time feeds for high frequency trading

➠ Proof of Reserve: Auditing stablecoin & RWA backing

➠ VRF: Verifiable randomness for gaming & NFTs

They’ve pushed into TradFi. They're working with @jpmorgan @Mastercard @Visa @UBS & others to bring institutional systems onchain.

Chainlink's new reserve mechanism works like a buyback program.

1/ They take protocol revenue & convert it to $LINK tokens instead of keeping cash (Have already made $2.8M in less than 2 weeks)

2/ No plans to touch reserves for years

Remember protocols with proper buyback systems are outperforming the market because they create constant buying pressure

Smart money is paying attention.

> Recently, a well known whale spent $21M buying nearly 1M $LINK tokens across multiple wallets

> This trader has a track record (made $4M during USDC depeg, dumped before UST/LUNA crash, perfectly timed SHIB peaks)

See as TradFi moves onchain, @chainlink becomes the infra layer connecting everything. Banks need oracles, compliance tools, crosschain capabilities. Chainlink provides all of it.

Tokenomics are deflationary with 1B max supply

Staking offers 4.32% yield with 45M token cap

All service fees convert to $LINK through payment abstraction

We're seeing early signs of institutional adoption accelerating.

10.2K

122

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.