I've been following Neutron's work on "supervault" since its demo phase. Needless to say, I'm a big fan of this new DeFi primitive.

I independently came up with the same idea (probably a little later than Elijah). It will be a core component of @dango's product offering.

If you have tried our testnet-2, most likely you've already traded against our passive market making vaults without realizing it.

Two ways the vaults will be tremendously valuable:

- For Dango, there's no need to pay external market makers hefty fees just to make the exchange usable. This allows us to direct as much value as possible to the Dango token.

- For retail investors, this opens up a new yield opportunity so far only available to sophisticated algorithmic traders.

=== nerd talks below ===

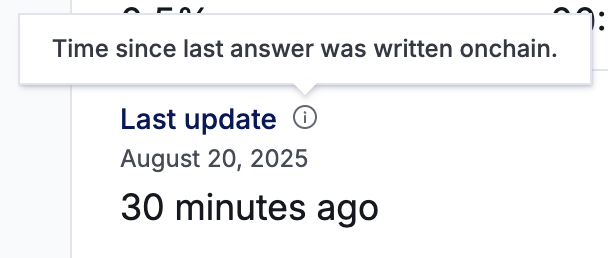

Creating this kind of vaults have historically been infeasible, due to the lack of fast oracles. For example, as I'm writing this sentence, Chainlink hasn't updated its BTC-USD price in half an hour (

Chainlink only push a price update onchain if the price changes more than a threshold (e.g. 0.5% for BTC). This is ok for lending protocols like Aave, but absolutely not ok for market making. If the vault places order according to an oracle feed that's even half a second too old, there can be arbitrage opportunity that allows high frequency traders to siphon value out of the vault.

Additionally, on general-purpose chains like Ethereum, there is MEV -- the oracle's operator needs to pay hefty fees in order to get their transactions prioritized, which can make whole thing economically infeasible.

I recommend this article on how legacy protocols (unsuccessfully) deal with this issue:

At Dango, we use @PythNetwork's 400 ms feed. We're also in the process of integrating their new 1 ms feed. The oracle updates will be submitted directly by the chain's validator, and pinned to the very top of the block. The vault has priority over other traders in adjusting its quotes in response to oracle updates. We also have circuit breakers that safeguard situations such as oracle downtime or obviously false data (like BTC suddenly goes from 120k to zero).

Thank you for your attention to this matter!

Almost a decade into the "DeFi experiment", one of the few enduring (and novel) products that DeFi has created are Tokenized LP positions.

There's really nothing like it.

In theory this should be incredible ! Onboarding active market makers is incredibly expensive in any market. The simplest explanation is that players sophisticated enough to market make have high opportunity costs. Democratizing market making _could_ be a great equalizer - everyone would get access to new sources of returns and markets would have deeper liquidity from their ability to cheaply onboard more funds.

But in reality, the Tokenized LP position has fallen flat. Much of the trading volume comes from arbitrageurs who are earning lucrative returns at the expense of LP losses. Most AMMs are too static to respond properly.

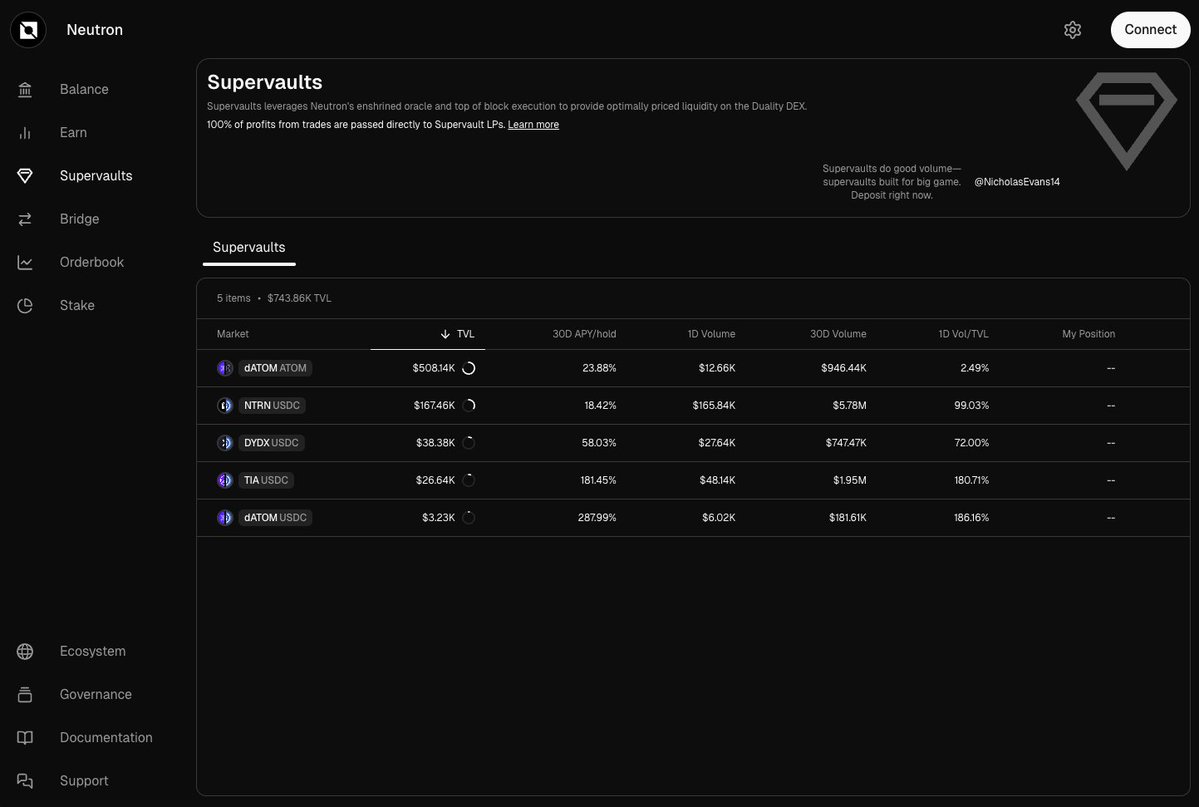

Supervaults are was our team's answer.

Every block, every validator votes on the price of an token. Rather than risking their votes being delayed, the price is updated at the top of the block. Supervaults are then given priority over other orders. At the top of the block they rebalance to the new price, before arbitrageurs are able to pick them off at the previous block's reported price. This provides some much needed protection for LPs.

There's going to be a lot of iteration required to perfect the parameters, design of the oracle, and priority system. But launching it as a protocol in production is a big milestone nonetheless. And I'm very excited to see what's in store.

14.88K

85

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.